L A N G I N S U R A N C E G R O U P

MEDICARE

Our Services

Lang's priority is helping clients make informed decisions about their benefits under Medicare. We do that first by listening and then by educating. We simplify complicated information and lay out suitable options, be they Medicare Supplements (aka "Medigap"), Medicare Advantage, or Part D Prescription Drug Plans. We never rush anyone's decision. We work with many carriers and don't play favorites. They all have strengths, and weaknesses.

It's All About Getting Educated

We help clients new to Medicare get a basic understanding of how Original Medicare works―what it covers (and not), complimentary product strategies, and considerations that inform each beneficiary's choices. This analysis differs from individual to individual, even with couples.

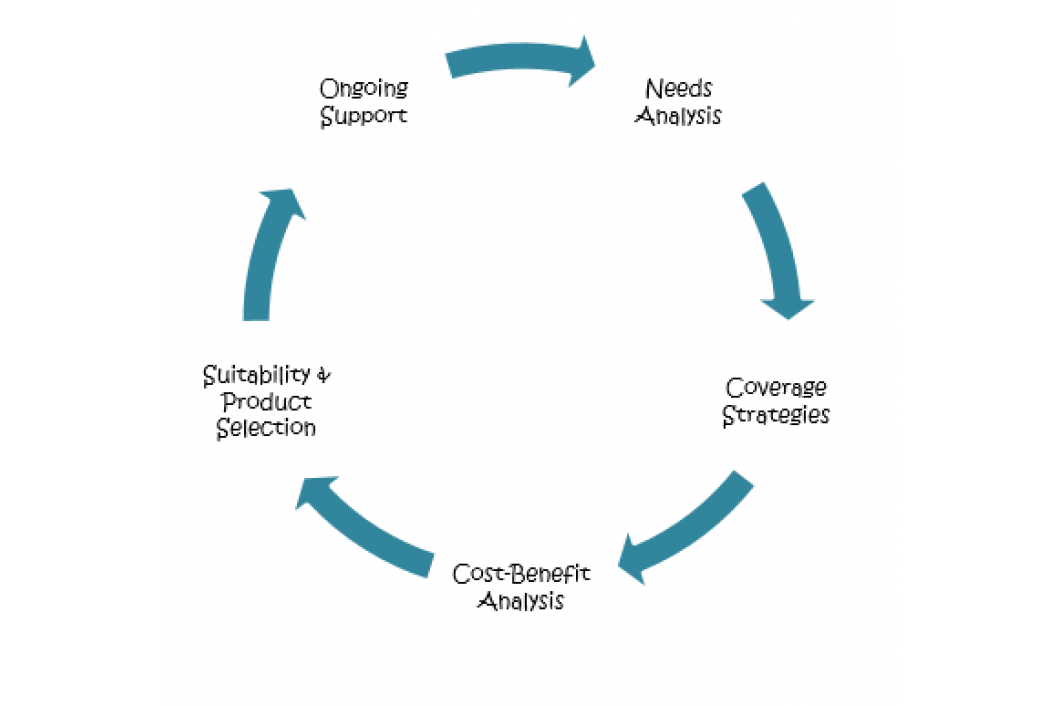

We follow a step-by-step process that's all about YOU―

- Requirements analysis and preferences for receiving care

- Strategies for choosing benefits

- Cost-benefit comparisons

- Suitability analysis and product selection

- Enrollment, support, and interim reviews

We also work with Certified Financial Planners to integrate Medicare planning into their clients' long-term financial strategies. And we routinely help small business owners weigh the risks and costs of leaving their company plan in favor of individual Medicare, but only in the context of a broader analysis.

Schedule Your Consultation Today

Contact Us

We will get back to you as soon as possible.

Please try again later.

We're Business Owners With an Eye on Costs

HEALTHCARE FOR SENIOR EMPLOYEES

Many people are continuing to work past the age of 65, yet businesses can't afford to fund the cost of healthcare for these valuable workers through traditional programs. There's a solution: "carve out" your senior employees from the company's group plan and offer them full medical and drug coverage through Medicare Supplements and Medicare Part D Prescription Drug plans. The company can save thousands of premium dollars each year, and senior workers often obtain more comprehensive coverage than they had on the company plan. Call us for a thorough cost-benefit analysis. We'll design a strategy, and then you can decide if a change is justified.

We also know dependability matters, and we don't go away after the sale. We take the initiative and offer annual and interim reviews. And we're tigers when it comes to reconciling claims or disputes, researching programs to defray costs, or just ordering new ID cards. Count on it!

Ancillary Services Complement Your Needs

Lang offers a variety of services in support of our clients. For clients who need help defraying drug costs, we have access to non-profits and charitable foundations that help clients obtain expensive medications for very low cost. We also can assist clients who've lost their employer benefits but are not yet ready for Medicare obtain private health coverage. That's particularly important with couples, when one spouse is ready for Medicare and the other is not. And we now offer the full complement of ancillary benefits for small businesses and their employees. Visit our pages labeled Lone Star Rx and Options Plus for more information.

The full complement of our ancillary services includes―

- Dental, Vision, and Ancillary discount plans

- Individual health plans under the Affordable Care Act

- Travel health insurance and trip cancellation

- Life, Final Expense, and Long-term Care

Lang will be offering services in Medicaid Planning. Our Certified Medicaid Planners (CMPs) will be working with a licensed elder care attorney to assure that all financial plans are in full compliance with NJ State law governing these services. Watch for our announcement.

309 Morris Ave. Suite H, Spring Lake, NJ 07762 (732) 282-2700

All Rights Reserved | Lang Insurance Group